Medical Mileage Deduction 2025 - What Is a Medical Mileage Deduction and How to Claim It? MileIQ, 17 rows find standard mileage rates to calculate the deduction for using your car for. The medical mileage rate for 2023 was 22 cents per mile. Let’s dive into the medical expense deduction and what role medical mileage plays.

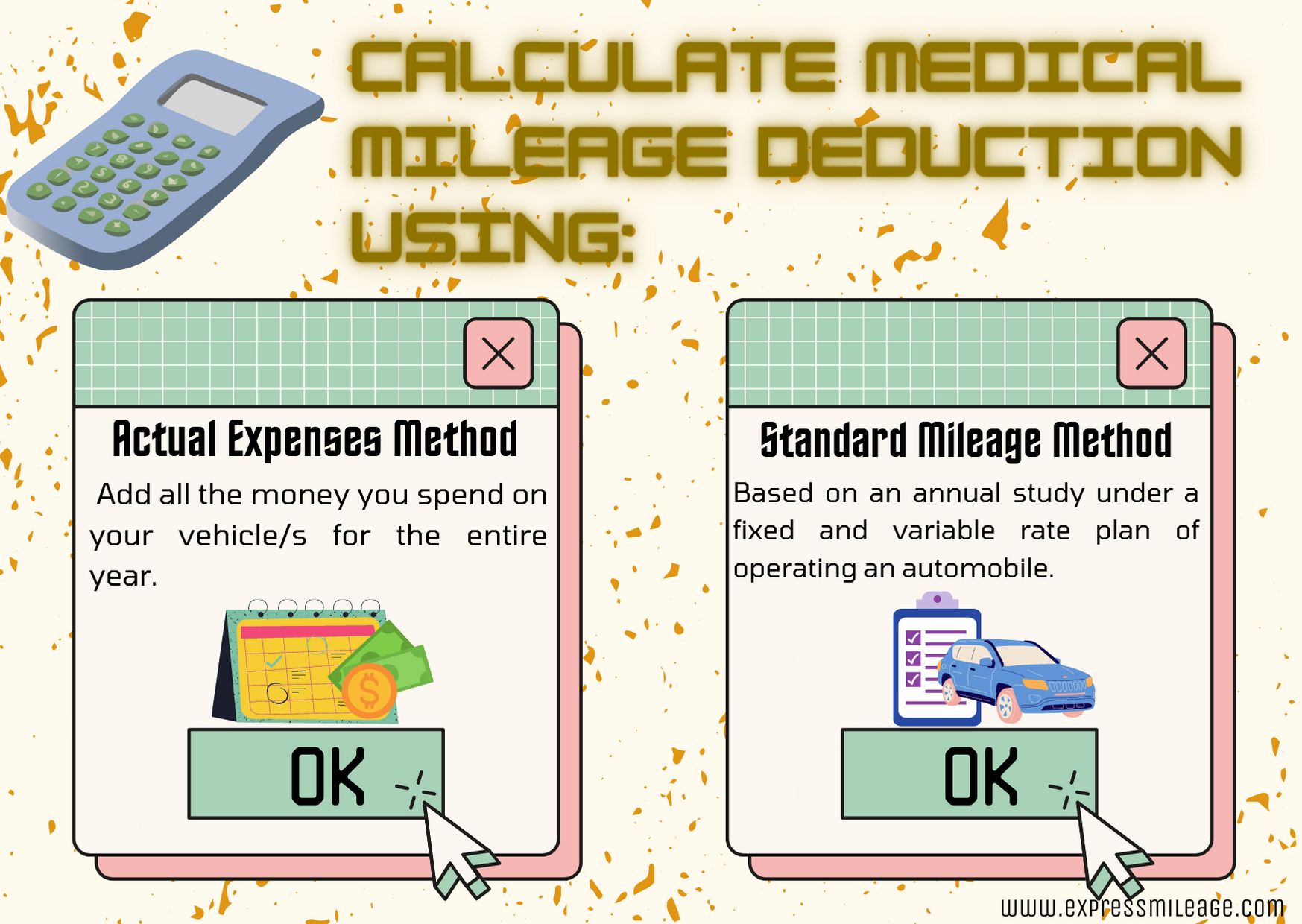

What Is a Medical Mileage Deduction and How to Claim It? MileIQ, 17 rows find standard mileage rates to calculate the deduction for using your car for. The medical mileage rate for 2023 was 22 cents per mile.

How to Claim Your Medical Care Expense Deduction ExpressMileage, In this comprehensive guide, we'll steer through the new 2025 irs mileage rates, delving into what they mean for you, how they compare to previous years, and. Today, the tax agency announced that on jan.

Medical Mileage Deduction on you taxes ExpressMileage, The medical mileage rate is the amount of money you can deduct from your taxes. The rc4065 is for persons with medical expenses and their supporting family members.

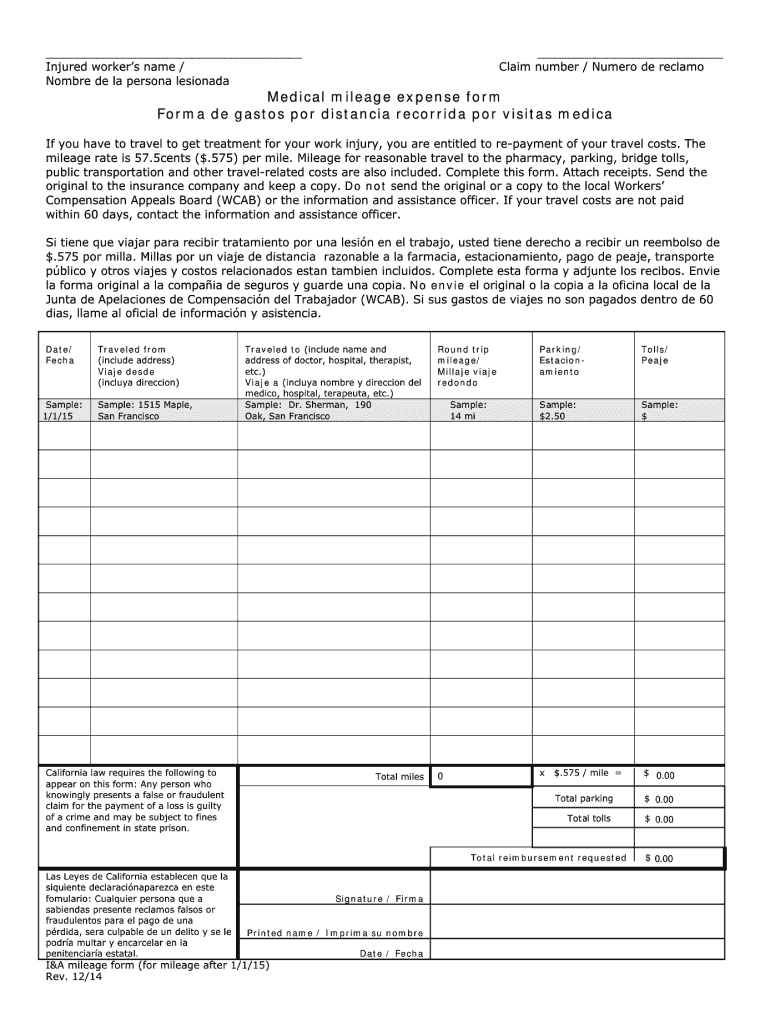

Medical Mileage Form 2023 Printable Forms Free Online, The rc4065 is for persons with medical expenses and their supporting family members. The medical mileage rate is the amount of money you can deduct from your taxes.

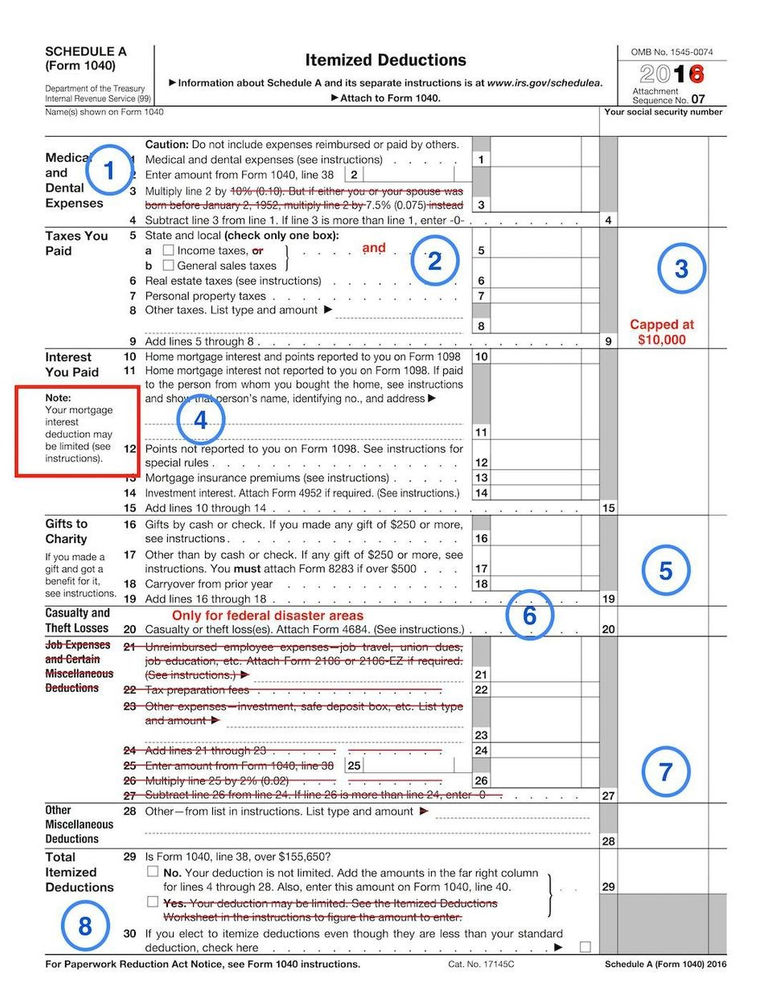

2025 Itemized Deductions Form Becka Klarika, 65.5 cents per mile for business purposes. The 2025 medical mileage rate is 21 cents per mile.

2025 Tax Medical Deductions Flore Jillana, The medical mileage rate is the amount of money you can deduct from your taxes. Let’s dive into the medical expense deduction and what role medical mileage plays.

The irs allows you to deduct mileage for medical care if the transportation costs are mainly for — and essential to — the medical care.

1, 2025, the standard optional mileage rate you can use to claim those eligible miles will go to 67 cents per. Do you drive for business, charity or medical appointments?

Here’s everything you need to know about the medical mileage deduction.

Deduction, Mileage, Need To Know, Everything, Medical, Business, 22 cents per mile for medical and moving purposes. Here are the details about claiming mileage on taxes.

Medical Mileage Deduction 2025. You can deduct medical expenses that exceed 7.5% of your adjusted gross income (agi). The guide gives information on eligible medical expenses you can claim on your tax return.